Table of Content

To qualify, most exchanges must merely be of like-kind—an enigmatic phrase that doesn’t mean what you think it means. You can exchange an apartment building for raw land or a ranch for a strip mall. You can even exchange one business for another but there are traps for the unwary. A taxpayer has a mixed-use vacation home that’s worth $1,000,000. If the taxpayer sold the home, they would report a $400,000 taxable gain ($1,000,000 minus $600,000) on Form 1040. Since the taxpayer is now over their Adjusted Gross Income , there are additional taxes owed as well.

Organized by cap rate, this curated collection features a range of the best established and up-and-coming markets for great returns. Regardless of where you buy, our vacation rental real estate network can help you find the perfect vacation rental property while navigating local regulations. After two years of capping your personal stays at your vacation rental to 14 days, and renting it out to guests for 10 times as much as you stay there, then you are free to stay as often as you’d like without further requirements. Acquisition of the like-kind replacement asset must be completed within 180 days from the close of sale on the relinquished property. Use of the subject real property by the investor or their family members will be considered "personal use" by the investor.

What to know about 1031 exchanges for investment properties

Fortunately, there’s a plan for that, as long as you want to keep the value in further real estate investments. There are currently no limits to how many times you can conduct a 1031 exchange. You can roll over the capitol gains from one investment property to another, and another. Even if each swap produces a profit, you can defer paying taxes until you sell for cash.

The publisher is not engaged in rendering legal or accounting services. If legal or tax advice is required, the services of a competent professional should be sought. HouseCashin is an all-in-one platform for residential real estate investors that maintains relationships with top-rated 1031 Exchange firms throughout the USA. To get connected with the best professionals and have your exchange processed safely and effectively, fill out the form below. Once again, each exchange is unique with its own set of facts and circumstances. You’ll need to be prepared to support investment intent, particularly if either property is held for less than one year.

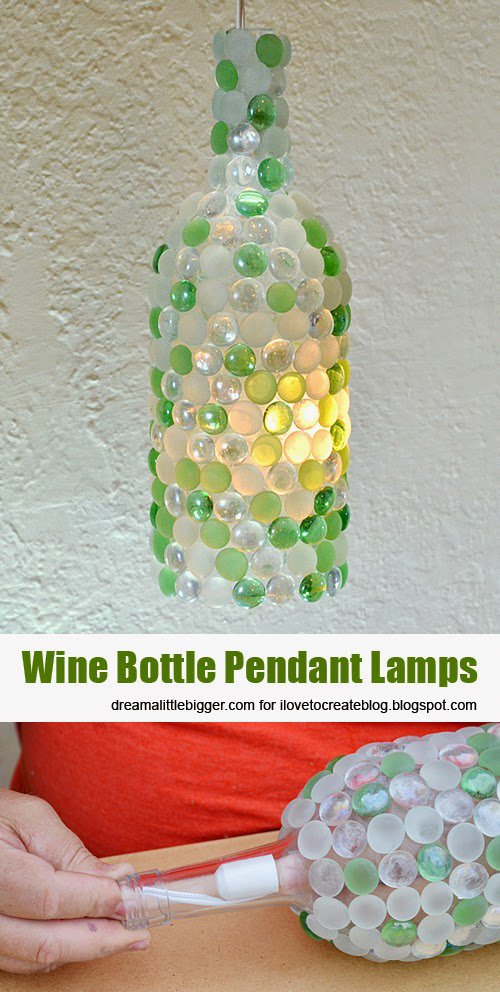

Free Printable – For Your Best Ideas

You’re also required to disclose the adjusted basis of the property given up and any liabilities that you assumed or relinquished. The transition rule is specific to the taxpayer and did not permit a reverse 1031 exchange in which the new property was purchased before the old property is sold. Before the passage of the Tax Cuts and Jobs Act in December 2017, some exchanges of personal property—such as franchise licenses, aircraft, and equipment—qualified for a 1031 exchange. The rules can apply to a former principal residence under very specific conditions. This article is for informational purposes only and is not intended to be a substitute for professional tax advice.

However, the many complex moving parts not only require understanding the rules, but also enlisting professional help—even for seasoned investors. It’s also possible to buy the replacement property before selling the old one and still qualify for a 1031 exchange. Are you seeking an income stream that is a bit more passive than maintaining a second home? Mineral rights are one of the best new properties that can be purchased income tax-free in a 1031 exchange. It is clear that a property that is exclusively rented at a fair market value qualifies for a like-kind exchange.

Choosing Qualified Opportunity Zone Funds in 2021

For most, the process of filing governmental paperwork and meeting strict deadlines can be daunting in an already busy life. Because of this, many sellers will choose to work with an intermediary in order to 1031 exchange vacation homes smoothly and make sure the reinvestment is maximized when identifying the new asset for the 1031 exchange. Any addition to the Qualified Use Period after living in the property is considered in calculating the exclusion amount. Say you complete a 1031 Exchange; rent out the property for two years; occupy it for three; and then rent it for another year before selling. You’re allowed four years of ownership toward the primary residence exclusion. Two-fifth of the $90,000 ($36,000) is subject to capital gain taxes for the two years of non-qualified 121 use as a rental.

2022 Real Living Real Estate, LLC. Real Living is a registered service mark.

Determining the Value of A Vacation Home

However, if the taxpayer wants to acquire another vacation home, they can do a Section 1031 Exchange. If the taxpayer finds another home worth $1,100,000, they would swap their old vacation home for the new one and throw in $100,000 cash to equalize the trade. As long as they have met the abovementioned guidelines for both properties, a tax-deferred Section 1031 Exchange is ok, and the taxpayer avoids any current income tax hit. Before you can 1031 exchange vacation home, you will first need to sell it. Chances are that you’ve had your fair share of offers from guests after their week in paradise.

The main thing to consider, however, is if the asset was held primarily for personal use and enjoyment or if it was rented out. For example, you acquired a replacement vacation rental with a $195,000 tax basis in a 1031 Exchange. When sold after five years, your realized capital gains of $100,000 with $10,000 of that gain representing depreciation recapture.

High-value vacation rentals are subject to capital gains taxes, which are deferrable in a simple 1031 exchange. The controversial part of this issue occurs when the personal use exceeds the limitations of IRC Section 280A, but the property is rented for part of the year. If the personal use limitations are exceeded then the property is not considered as being held for business but could qualify as an investment property. Most practitioners maintain that Section 280A does not determine if the property can qualify for a like-kind exchange. What Section 280A does is establish specific rules on what tax deductions can be taken if personal use exceeds the established limits.

Michael Reesink’s testimony supports the proposition that at the time of the exchange, petitioners held the Laurel Lane property with investment intent. Successful exchanges can be completed under two years but with attending risk. The central issue is demonstrating investment intent for holding the property being exchanged. From the 1031 perspective, the loan documents are between the taxpayer and the lender. The Qualified Intermediary does get involved in the loan process but only in reverse exchanges when the property parked with the Exchange Accommodator Titleholder is on title. The 1031 exchange refers to the section of the Federal tax code that covers re-investing your profits from the sale of a second home into another of higher value.

You can even delay the process so that you get the right property to replace your old one. To take advantage of Section 121, you need to have lived in the home for two of the last five years. The IRS allows you to aggregate time lived in the home during a five-year span to meet the two-year requirement. Fair market rental rates are based upon all of the facts and circumstances that exist when the rental or lease agreement is entered into. All rights and obligations of the rental or lease agreement are also taken into account. If the IRS believes that you haven’t played by the rules, then you could be hit with a big tax bill and penalties.

No comments:

Post a Comment